Holidays Act NZ: Stay compliant before & after the Employment Leave Bill

Recap on the Holidays Act

Holidays Act Compliance: Still essential until the Employment Leave Bill passes.

Download our desk guide- 5 essential tips for navigating The Holidays Act →

In this Guide

For years, businesses have wrestled with confusing entitlements, tricky calculations, and payroll systems that groan under the weight of complexity. And when mistakes happen, that holiday spirit can disappear fast.

The purpose of the Holidays Act was simple: to ensure people get the correct entitlements and payments. However, even the most diligent employers have tripped up, and payroll audits aren’t always forgiving.

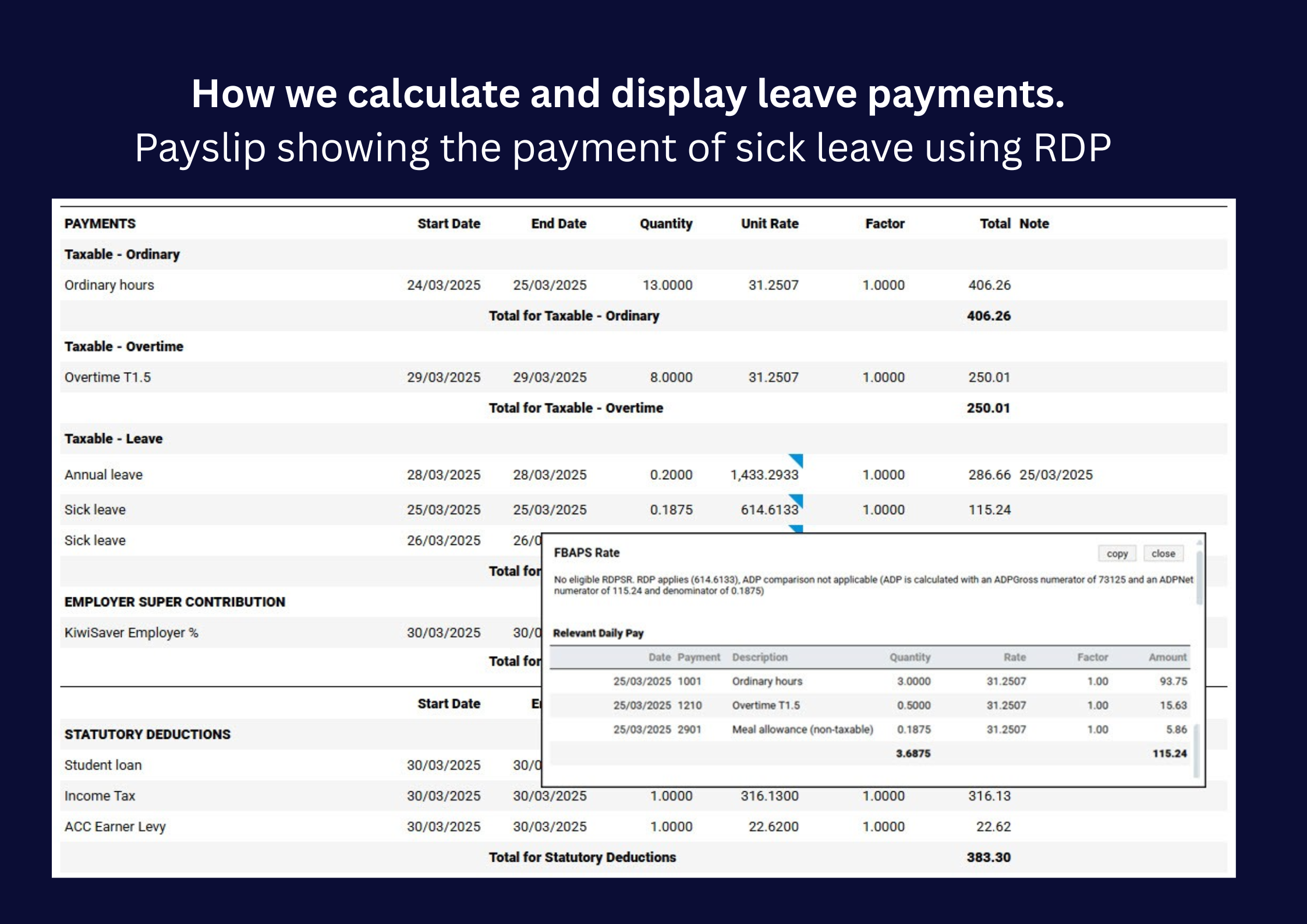

This is exactly why we’ve always stood out. While others were scratching their heads over complex Holidays Act requirements like Relevant Daily Pay (RDP), we’ve been helping customers configure systems, and avoid costly “oops” moments.

Because it takes both Time & Attendance (T&A) and Payroll to determine the correct rate, we’ve pulled together this guide to show how TimeFiler helps organisations across New Zealand stay compliant with the Holidays Act.

Topics we will cover in this guide

Remediation

Employment Leave Bill

Public Holidays: Understanding Entitlements

Public holidays can be tricky, and a common question employers ask is:

“How do I calculate leave for this employee?”

TimeFiler simplifies this with a clear decision flow:

Determine if the day would otherwise be a working day (OWD) for the employee.

If yes → move to the payment calculation section (see FBAPS: Payments for Leave Types).

If no → no payment is required.

When a public holiday is Mondayised

When a public holiday falls on a weekend, it may be observed on a weekday.

For example, if Christmas Day falls on a Sunday, employees who normally work Monday to Friday will observe it on Monday.

For organisations that operate on weekends:

- Employees who work on the actual public holiday are paid for working and receive an Alternative Holiday if it’s an OWD.

- If they work on the observed day (e.g., Tuesday if Monday is Boxing Day), they are paid ordinary time.

FBAPS: Payments for all leave types

FBAPS stands for Family violence, Bereavement, Alternative holidays, Public holidays, and Sick leave, all of which require accurate calculations.

Once you know a public holiday applies, the next question is:

“Am I paying Relevant Daily Pay (RDP) or Average Daily Pay (ADP)?”

FBAPS leave isn’t a flat rate. It must reflect the RDP, ADP, or RDPSR (Relevant Daily Pay at Special Rate).

Key considerations:

ADP can’t be used when it’s lower than RDP (compliance issue).

Some companies choose to always pay ADP for simplicity, but that can create risk.

TimeFiler ensures the correct method is applied automatically.

With the right calculations, your payroll stays accurate, compliant, and fair.

Annual leave calculations are another area prone to error. Employers often struggle with Ordinary Weekly Pay (OWP) calculations, especially when hours or earnings vary.

There’s also complexity with part-days, splitting a daily rate doesn’t always work.

TimeFiler combines your time and attendance data to calculate accurate OWP, ensuring reliability and compliance.

Identify discrepancies before auditors do

Correct entitlements efficiently

Minimise the risk of penalties

This proactive approach means you’re always prepared, even as payroll rules and systems evolve.

Employment Leave Bill: No need to panic!

The Government plans to replace the Holidays Act 2003 with a new framework, the Employment Leave Bill.

For employers, this means change, sometimes significant. For TimeFiler customers, it might just mean a few configuration updates.

Either way, transitions like this bring system updates, policy adjustments, and process shifts. In short, compliance isn’t going on holiday anytime soon.

The good news:

- Your existing records remain valid

- Calculations under the new law can still reference historical data

- From the Holidays Act 2003 to today, we’ve implemented NZ leave rules in real systems — entitlements, pay calculations, and compliance.

You're in good hands.

Why trust TimeFiler?

For twenty years, we’ve helped organisations navigate the Act’s complexities with confidence.

Our track record includes:

Untangling leave calculations

Supporting payroll teams so they don't lose sleep

Preparing customers for changes before they land

We’ll keep you updated as the new Employment Leave Bill progresses and help you stay compliant every step of the way.

Whether the Employment Leave Bill swoops in to save the day or the Holidays Act lingers a little longer, one thing’s certain:

Businesses need a partner who knows payroll compliance inside out.

At TimeFiler, we’ll keep connecting the dots between timesheets, payroll, and compliance.

Book a free consultation with a TimeFiler expert today

You May Also Like

These Related Stories

Switching payroll systems? We’ll make it simple and stress-free.

.png)

When Christmas comes early: negotiating holiday pay before the silly season.

.png)